ANALYSIS: TRUE. Leftists are wrong. Western culture is not white supremacy.

Archive for 2023

June 3, 2023

WINNING: Ben Shapiro Praises Musk For Keeping Free-Speech Pledge After ‘What Is A Woman?’ Is Restored. “Friday, Twitter’s tag restricting the visibility of “What is a Woman?” was removed, allowing Twitter users to like and retweet the documentary, and Musk tweeted out the film to his 140 million followers.”

#RESISTANCE:

#Antifa and supporters of children’s pride events retreated following a fight outside Saticoy Elementary in Los Angeles. Mostly Armenian-American families gathered to protest the school’s pride celebrations. pic.twitter.com/bUTSYgpRLB

— Andy Ngô 🏳️🌈 (@MrAndyNgo) June 2, 2023

UNEXPECTEDLY! The Spectacular Corporate Hypocrisy on Gay Rights and Uganda.

Uganda modified its recent laws punishing homosexuality, and so it’s no longer a crime to say you’re gay. But it is still a crime to exhibit any form of homosexual desire:

Existing, colonial-era law in Uganda already allows life sentences for homosexuality, but no one has been convicted of consensual same-sex relations since the country gained independence from Britain in 1962. The new bill reaffirms that punishment and allows prison terms of up to five years for actions such as touching another person “with the intention of committing the act of homosexuality.”

Uganda also kept the provision that included a “death sentence for what it calls ‘aggravated homosexuality,’ acts that include same-sex intercourse with a minor or an HIV-positive person convicted for the second time for intercourse with someone of the same gender.”

I think we can all agree that an adult having sex with a minor is a serious crime; here in the U.S., as of 2018, the average sentence for offenders convicted of statutory rape was 30 months. Hopefully we all agree that those who are HIV-positive have a responsibility to inform their partners and take appropriate precautions. But to enact the death penalty against HIV-positive Ugandans is almost absurd, as HIV has already been a de facto death penalty for roughly 1.4 million Ugandans since the advent of the virus. This is not all that far from criminalizing attempted suicide and then punishing it with the death penalty.

Even those with the most cursory knowledge about Uganda know the country faces some real problems. As the CIA World Factbook summarizes, Uganda “faces numerous challenges that could affect future stability, including explosive population growth, power and infrastructure constraints, corruption, underdeveloped democratic institutions, and human rights deficits.” Uganda ranks 166th out of 191 in the United Nations’ annual ranking of human development, 125th out of 139 countries on the rule of law, 142nd out of 180 in corruption, and 121st out of 163 in peace and stability, and ranked 115th out of 141 in pre-Covid economic competitiveness. Roughly one in five Ugandans lives below the poverty line. Roughly one in five children between the ages five and 14 are in the workforce instead of school. As of 2019, just 17 percent of the country’s rural areas had access to electricity. As the Factbook states, “Uganda is subject to armed fighting among hostile ethnic groups, rebels, armed gangs, militias, and various government forces that extend across its borders.”

And this is all separate from the Ebola-virus outbreak.

The heterosexuals of Uganda have their own major challenges as well:

“Except in urban areas, actual fertility exceeds women’s desired fertility by one or two children, which is indicative of the widespread unmet need for contraception, lack of government support for family planning, and a cultural preference for large families. High numbers of births, short birth intervals, and the early age of childbearing contribute to Uganda’s high maternal mortality rate.”

Add it all up, and Uganda looks like a deeply troubled country beset by poverty, instability, violence, lack of infrastructure, insufficient educational and economic opportunities, corruption, and ineffective government policies. And in this light, gay and lesbian Ugandans start to look like a very convenient scapegoat for the state. (For example, the challenges connected to the country’s high birthrate are really not the fault of the country’s gays and lesbians.)

With so many problems, you might wonder who would want to do business in a place like Uganda. The answer turns out to be quite a few multinationals: Coca-Cola, Unilever, Diageo, Citibank, Hilton and Sheraton hotel chains and . . . wait for it . . .

Anheuser-Busch InBev. Yes, the same company that is seeing plummeting sales of Bud Light over the perception that it jumped into the culture wars in the United States also operates breweries, factories, and distribution networks in a country that criminalizes homosexuality. Call me crazy, but I think I see some inconsistencies there.

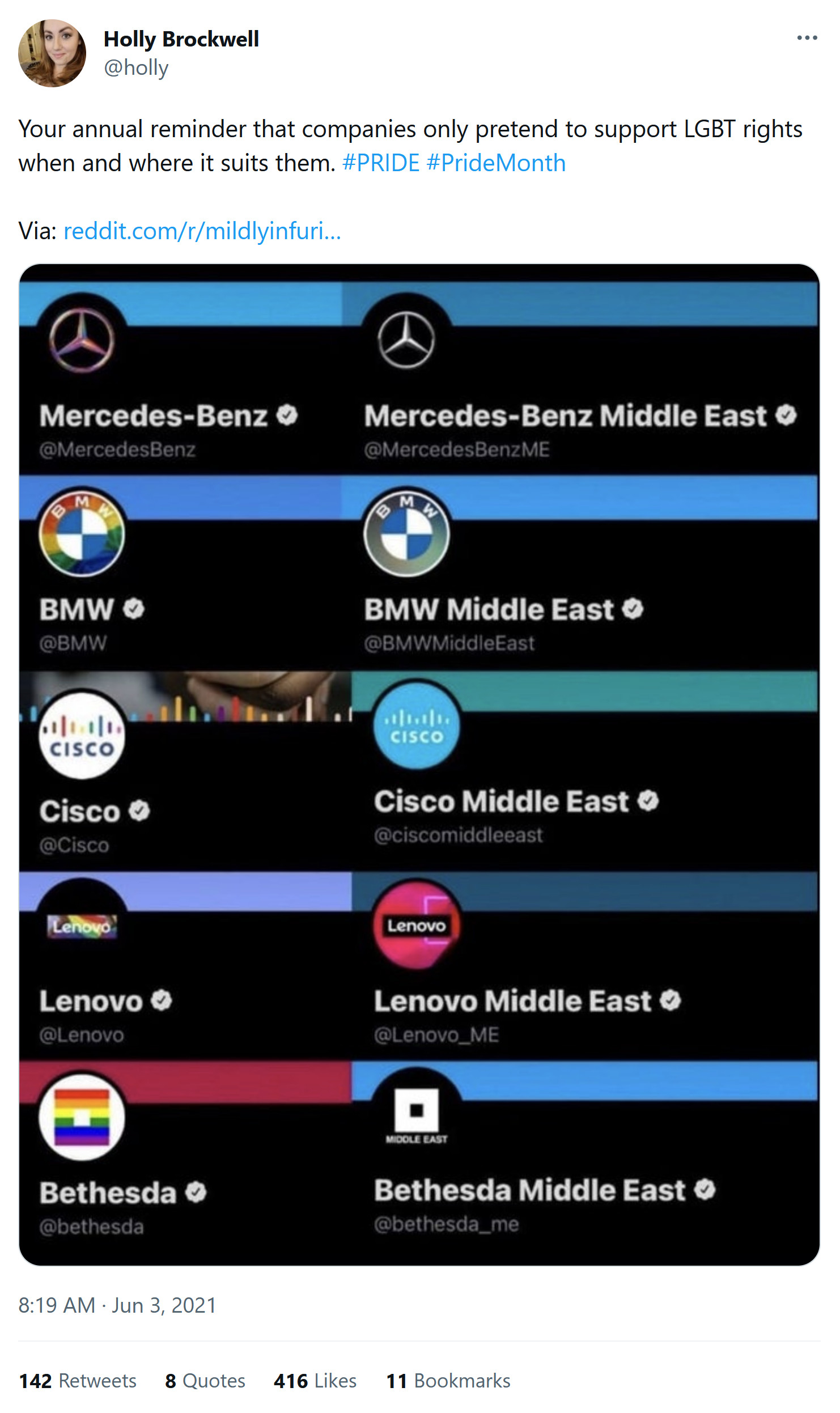

Related: Corporate accounts reflect Pride Month (but there are exceptions).

MATTHEW CONTINETTI: The Secret to McCarthy’s Success: The GOP speaker knows his role and plays it well.

It occurs to me that he’s third in line for the presidency behind two very unpopular people. I’ll bet it’s occurred to him, too.

DEAL OF THE DAY: Lumbar Support Pillow for Back Relief. #CommissionEarned

WOW: McCarthy nears best speaker territory, 50% approve.

Today, Rasmussen Reports put McCarthy on the throne of public approval. He now has a 50% favorable rating, higher than former Speaker Nancy Pelosi reached in her second stint in the top job, according to a YouGov polling timeline for her. And many have declared her one of the greatest House speakers.

McCarthy, who had to fight through over a dozen ballots to win the top House job, has reached his new high on the success of the debt deal he cut with President Joe Biden. He and his surrogates have been able to sell the benefits of the package, unlike many Republicans before him.

As a result, 65% of Republicans and 43% of Democrats approve of McCarthy.

Okay, but “more popular than Nancy Pelosi” isn’t how I’d sell it.

WHO ARE YOU GOING TO BELIEVE, ME OR YOUR LYING EYES (AND EARS)? Tyler O’Neil: Children’s Choir Director Responds After Capitol Police Claim They Did Not Stop Kids Singing the National Anthem.

HMM: Husbands with Much Higher Incomes Than Their Wives Have a Lower Chance of Divorce. “Research in evolutionary psychology suggests that financial prospects are more of a priority for women than men when choosing a spouse, and that this is the case around the world.”

June 2, 2023

THEY CAN’T EVEN STOP NOSOCOMIAL INFECTIONS: Philadelphia hospital forms task force to help curb gun violence.

IT’S NOT THAT CONVINCING WHEN YOU’RE LYING:

Missouri vs Biden. Can the gov't tell social media to violate the First Amendment?https://t.co/XlvC9LJcaT

— wretchardthecat (@wretchardthecat) June 2, 2023

OVER AT SUBSTACK, I talk about the Supreme Court and libel law, and what I think the Court is likely to do. (Bumped).

OPEN THREAD: Thank God it’s Friday. Only two more working days until Monday.

WELL, THAT’S CONSISTENT WITH HIS TRACK RECORD TO DATE: Joe Biden is about to pick the worst possible person to become the next CDC head. “I’m not exaggerating. Dr. Mandy Cohen, the likely choice, is a public health Covid authoritarian and former chief of staff for censorer-in-chief Andy Slavitt.”

WOEING: Boeing delays 1st Starliner astronaut launch for NASA indefinitely over parachute, wiring safety issues. “The Starliner astronaut launch, already years behind schedule, was most recently targeted to launch two NASA astronauts to the International Space Station on July 21. Now, it likely won’t launch at all this summer, and may not get off the ground this year.”

I talked to an undergraduate engineering student who worked on Starliner as a co-op a few years ago and she said that nobody there expected it to actually fly as promised.

EVERYTHING IS GOING SWIMMINGLY:

And here are the BLS revisions for the fake Q1 2023 data they released.

Don't be surprised. The CPI data is fake also, massaged downwards to make inflation appear lower than it really is. Plus they are also playing games with the employment jobs creation numbers. https://t.co/sgBn3o7g6P pic.twitter.com/vMQqbjoynJ

— Wall Street Silver (@WallStreetSilv) June 1, 2023

THAT’S QUITE A GLITCH: Software snafu leads to 400 individuals getting bogus letters saying they might have cancer.

WILL BEING SKINNY STOP BEING CHIC WHEN IT’S EASY? Staggering Results of New Weight Loss Drugs May Be Revolutionary, Expert Says.

GOOD, IT’S UNPATENTED AND CHEAP: Anti-inflammatory drug colchicine may prevent knee, hip replacement.

I CAN’T TELL IF THIS IS REAL OR FAKE, AND IT’S DISTURBING EITHER WAY:

@prepforceone #secretarybootyjuice #fyp #biden #petebuttigieg #democrat #democrats #bidenisajoke #bidenisafailure ♬ original sound – Prep Force One

I’VE NOTICED MORE AND MORE BANKS ARE PUTTING LIMITS AND DELAYS ON WITHDRAWALS: Apple Customers Say It’s Hard to Get Money Out of Goldman Sachs Savings Accounts.

Apple’s AAPL 1.60%increase; green up pointing triangle savings account, a partnership with Goldman Sachs GS -2.32%decrease; red down pointing triangle, launched in April to great fanfare. Some customers say it has been hard to get their money out.

Nathan Thacker, who lives outside Atlanta, had been trying to transfer $1,700 from his Apple account to JPMorgan Chase since May 15. Each time he called Goldman’s customer service department, he said, he was told to give it a few more days.

The money arrived in his Chase account Thursday morning, he said, after The Wall Street Journal contacted Goldman about his and other customers’ experiences.

Others said they also had trouble transferring money from their new Apple accounts. Customer service representatives at Goldman, which holds the deposits, sometimes gave differing responses about what to do, they said. Sometimes, their money appeared to have simply vanished, not showing up in their Apple account or in the account they were trying to move it to. . . .

On brand-new accounts, like Apple’s, transfers that make up a large share of the overall balance can trigger anti–money-laundering alerts or other security concerns that require additional review, according to people in the AML field. Those delays usually last five or so days, they said.

It can also be a red flag when a customer tries to transfer a large amount of money from a newly opened savings account into an account that is different from the one where the money originally came from.

Min-Jae Lee was curious to try out the Apple account and intrigued by its high interest rate. She deposited $100,000 in April, but soon decided she would rather have her money elsewhere. On May 1, she tried to transfer it out.

It took more than three weeks for her to get it.

Lee, a lawyer, said Goldman told her to contact JPMorgan Chase, where she was trying to move the money. Then, on Goldman’s advice, she tried sending the money to her Vanguard account. The $100,000 moved there before going back to Apple the same day, she said.

Goldman then called her, she said, and told her that the money could be transferred only to the account from where she had sent it. She initiated a transfer to Ally on May 16.

A few days later, Goldman told her that her account was under a security review.

Her Apple account showed a zero balance, but the money wasn’t in her Ally account either. It finally showed up there on May 25. She isn’t entirely sure why.

It is reasonable that a bank would delay a transfer to do enhanced due diligence, but the length of the delay in these cases is surprising, said Dennis Lormel, who worked on financial crimes for the U.S. government for three decades and now is a bank consultant.

“A two- to four-week delay definitely seems long,” he said. “As someone who deals with banks on a frequent basis, to me that seems unreasonable.”

It does.

But hey, you don’t have to worry about a bank run if depositors can’t get their money.

I THINK I KNOW WHICH WAY TO BET: Vehicle-to-Grid (V2G) Charging: A Way for EV Owners to Make Money or a Pipe Dream?

NEWS YOU CAN USE: The Family Must Be Part of the Personal Defense Plan.