FOUR YEARS AGO TODAY IN THE ATLANTIC:

As Jon Miltimore of the Foundation for Economic Education wrote a year later: Today Is the 1-Year Anniversary of the Worst Pandemic Headline of 2020.

It’s a headline that certainly grabs your attention.

“Georgia’s Experiment in Human Sacrifice,” read the title of an April 29, 2020 article in The Atlantic.

Written by staff writer Amanda Mull, the story suggested Georgia Gov. Brian Kemp’s decision to reverse course on the state’s shutdown and lift restrictions on businesses was an experiment to see “how many people need to lose their lives to shore up the economy.”

The decision, readers were told, was reckless and deadly.

“Public-health officials broadly agree that reopening businesses—especially those that require close physical contact—in places where the virus has already spread will kill people,” Mull wrote.

Without the government to protect them, all Georgians could do is “try to protect themselves as best they can,” Mull said. But she concluded that, because of the way the virus works, another deluge of cases “could be inevitable.”

“[It] may be two or three weeks before hospitals see a new wave of people whose lungs look like they’re studded with ground glass in X-rays,” Mull wrote. “By then, there’s no telling how many more people could be carrying the disease into nail salons or tattoo parlors, going about their daily lives because they were told they could do so safely.”

To be fair, then-President Trump had similar fears as Mull when Gov. Kemp said he wanted to reopen the state:

In April 2020, businesses in Georgia were shuttered by government decree as in most of the rest of the country. Mr. Kemp was hearing from desperate entrepreneurs: “ ‘Look man, we’re losing everything we’ve got. We can’t keep doing this.’ And I really felt like there was a lot of people fixin’ to revolt against the government.”

The Trump administration “had that damn graph or matrix or whatever that you had to fit into to be able to do certain things,” Mr. Kemp recalls. “Your cases had to be going down and whatever. Well, we felt like we met the matrix, and so I decided to move forward and open up.” He alerted Vice President Mike Pence, who headed the White House’s coronavirus task force, before publicly announcing his intentions on April 20.

That afternoon Mr. Trump called Mr. Kemp, “and he was furious.” Mr. Kemp recounts the conversation as follows:

“Look, the national media’s all over me about letting you do this,” Mr. Trump said. “And they’re saying you don’t meet whatever.”

Mr. Kemp replied: “Well, Mr. President, we sent your team everything, and they knew what we were doing. You’ve been saying the whole pandemic you trust the governors because we’re closest to the people. Just tell them you may not like what I’m doing, but you’re trusting me because I’m the governor of Georgia and leave it at that. I’ll take the heat.”

“Well, see what you can do,” the president said. “Hair salons aren’t essential and bowling alleys, tattoo parlors aren’t essential.”

“With all due respect, those are our people,” Mr. Kemp said. “They’re the people that elected us. They’re the people that are wondering who’s fighting for them. We’re fixin’ to lose them over this, because they’re about to lose everything. They are not going to sit in their basement and lose everything they got over a virus.”

Mr. Trump publicly attacked Mr. Kemp: “He went on the news at 5 o’clock and just absolutely trashed me. . . . Then the local media’s all over me—it was brutal.” The president was still holding daily press briefings on Covid. “After running over me with the bus on Monday, he backed over me on Tuesday,” Mr. Kemp says. “I could either back down and look weak and lose all respect with the legislators and get hammered in the media, or I could just say, ‘You know what? Screw it, we’re holding the line. We’re going to do what’s right.’ ” He chose the latter course. “Then on Wednesday, him and [Anthony] Fauci did it again, but at that point it didn’t really matter. The damage had already been done there, for me anyway.”

The damage healed quickly once businesses began reopening on Friday, April 24. Mr. Kemp quotes a state lawmaker who said in a phone call: “I went and got my hair cut, and the lady that cuts my hair wanted me to tell you—and she started crying when she told me this story—she said, ‘You tell the governor I appreciate him reopening, to allow me to make a choice, because . . . if I’d have stayed closed, I had a 95% chance of losing everything I’ve ever worked for. But if I open, I only had a 5% chance of getting Covid. And so I decided to open, and the governor gave me that choice.’”

At that point, Florida was still shut down. Mr. DeSantis issued his first reopening order on April 29, nine days after Mr. Kemp’s. On April 28, the Florida governor had visited the White House, where, as CNN reported, “he made sure to compliment the President and his handling of the crisis, praise Trump returned in spades.”

Three years later, here’s the thanks Mr. DeSantis gets: This Wednesday Mr. Trump issued a statement excoriating “Ron DeSanctimonious” as “a big Lockdown Governor on the China Virus.” As Mr. Trump now tells the tale, “other Republican Governors did MUCH BETTER than Ron and, because I allowed them this ‘freedom,’ never closed their States. Remember, I left that decision up to the Governors!”

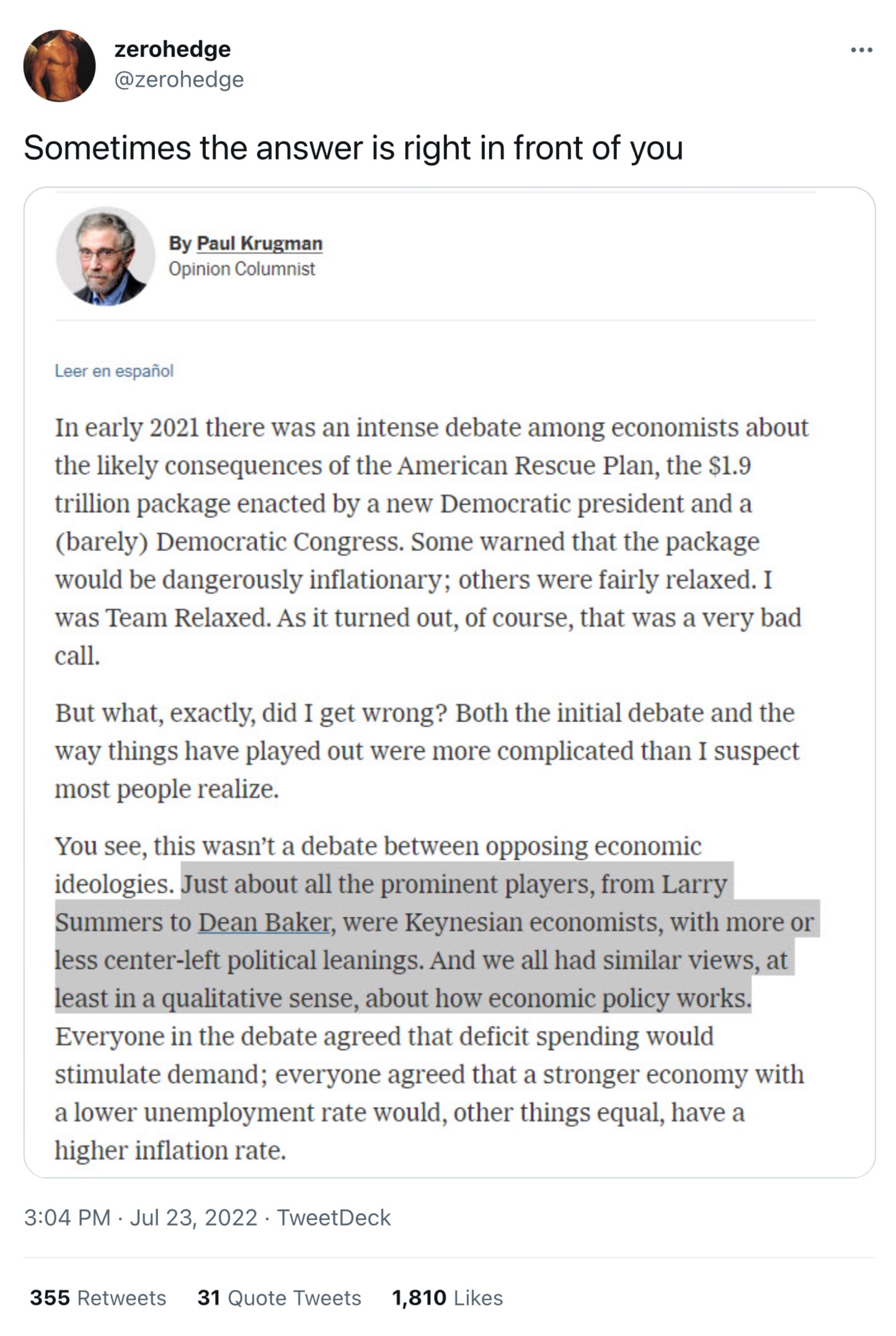

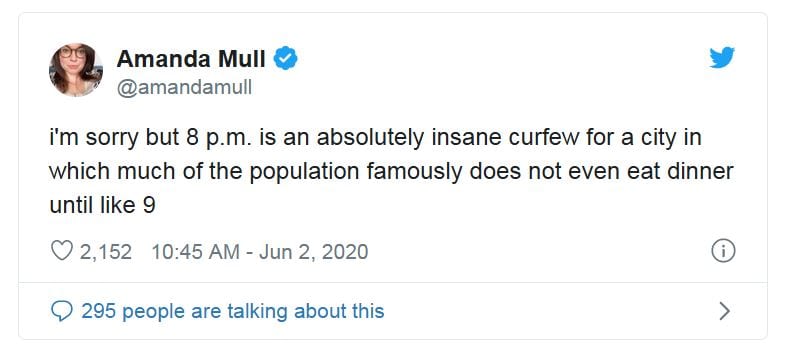

Curiously, Mull rather quickly got over her initial apocalyptic response, tweeting just a couple of months later: Atlantic writer who warned of Georgia’s human sacrifice by reopening says New York’s 8 p.m. curfew is ‘absolutely insane.’

But then, many on the left forgot their obsession with lockdowns, when, to paraphrase Martha and the Vandellas, the summer of 2020 was here, and the time was right for rioting in the street.