CREDIT MARKETS GO JOHN GALT?

People are reeling from having their 401ks wiped out in the current market slide. And now those who had for years bought what they thought were “safe” blue-chip corporate bonds are discovering they were only safe until they were told by the government to go fly a kite because government wants to pay off the unions instead. That is deeply unfair to small bondholders, and it’s dreadful economic policy. As a friend of mine put it to me, “Who in their right mind will buy corporate bonds now? And if nobody’s buying bonds, how exactly are our debt markets going to get humming again? What a mess.”

Indeed. This could be the continuation of the Tea Party phenomenon, manifesting itself in a different way.

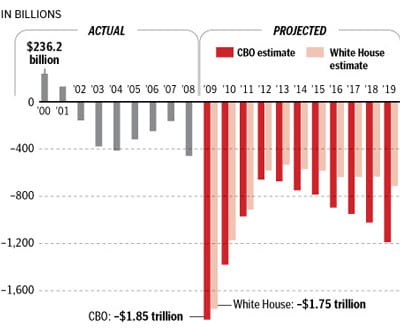

If you set out to wreck the non-governmental parts of the economy, you could hardly do a better job. And, frankly, the governmental parts aren’t being handled much better. I mean, how much safer are U.S. Treasury bonds in the face of this attitude, and towering piles of debt?

UPDATE: TigerHawk emails:

Yes, the situation with the auto workers is a mess and the small bondholders are getting whacked, but it is far from clear that the example of the GM situation will hurt credit markets. First, the credit markets have actually been improving in recent weeks (while the automakers have been understood as zombies), with more money flowing in to mutual funds that invest in bonds, yields on corporate bonds (among other instruments) slowly declining (meaning bond prices are going up), and, finally, a few original issuance “high-yield” bond deals actually getting done. So I am not sure the auto deal is in fact causing the credit markets to go “John Galt,” for which we should all be grateful. Second, in general the Paulson/Geithner era has been extremely solicitous of bondholders and other creditors. The equity has gotten crushed, the executives have been taken to the woodshed, but the government has been all about protecting the creditors, even to the point of serious moral hazard (thinking primarily of the AIG counterparties, who are the main and possibly only beneficiaries of the AIG “bailout”).

Well, I hope that’s right.