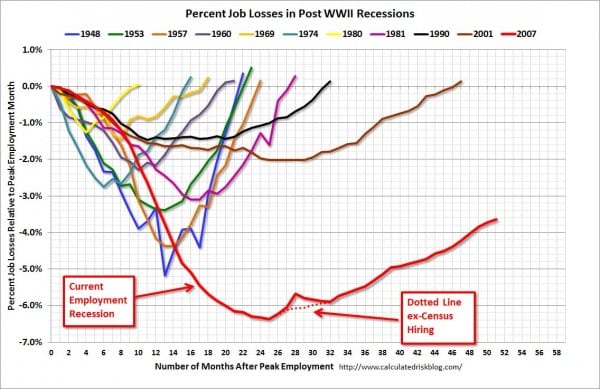

HOW’S THAT HOPEY-CHANGEY STUFF WORKIN’ OUT FOR YA? (CONT’D): Jobs? What Jobs? Note this chart in particular:

Why have jobs recovered so slowly, and so little, compared to past recessions?

UPDATE: Reader John Hawkins — no, not that one, another John Hawkins — writes: “You keep saying that Jimmy Carter is a best-case scenario for Broke Obama, and looking at that jobs chart confirms it, at least when it comes to employment. Carter’s recession is the yellow line up in the corner. The current red line is four times deeper and five times longer.”

And reader Brock Cusick emails:

Glenn, this chart is more important than just Obama’s awful stewardship of the economy. Look closer. Look at how each recovery takes longer than the previous one. The longest recovery prior to this one was 2001, and the longest recovery before that was 1991. This is a chart of demosclerosis. We don’t just need to get rid of Obama. We need a hard reset of the entire Federal apparatus. A do-over, if you will. Or the next recession will be even worse – no matter who’s in office.

Here’s a simple solution: Any Federal agency which isn’t delivering real value, is shut down. Give the employees a generous exit package to lessen the human cost, but get the regulators to stop interfering with the economy. And any Federal agency that’s kept, gets six months to re-write the regulations so that they’re clear, transparent, market friendly, and less than 100 pages in length.

And, of course, pass a major tax reform. Make the tax code 10 pages in length. Make that a hard cap.

Works for me.

ANOTHER UPDATE: Economic historian Eric Schubert writes:

There are two basic reasons why the job situation remains so tough:

First, the current recession is a classic balance sheet recession that was 30 years in the making. The housing bubble of the last decade was the culmination of our increasing love of debt and our failure to save. Nouriel Roubini called it four years ago. His analysis – along with Gary Schilling’s – still holds. The large run-up of government debt under the Obama Administration has allowed private balance sheets to heal. – a process very similar to what Nordic countries faced in the 1990s. The process would have happened if John McCain had won in 2008. An inevitability, unless you want 25-30 percent unemployment over a very short period of time. Low job growth is a function of the laws of economics, not politics.

The problem we now face is that next year the government balance sheet will need to be addressed, which will prolong the hiring slump over the next five years. No sign President Present is up to that job.

Second, there is a structural mismatch on skills and education young men and women are getting and what is needed in the economy. Walter Russell Mead has been writing on the subject extensively for the past year. Too many folks leaning on the Blue Social Model for their future; education needs serious reform. Arnold Kling wrote a convincing column months that there is some strong evidence that a comparable mismatch also prolonged the Great Depression.

http://www.american.com/archive/2011/november/what-if-middle-class-jobs-disappear

While I agree with some of Mr. Cusik’s ideas, Obama has done little either way to impact employment. What he did with the stimulus package, however, was one of the most egregious forms of crony capitalism in the history of this country. And as Michael Barone has repeatedly commented, the President still pushes the outdated Blue Social Model from the 1950s, which makes him more of a square than Governor Romney! In that respect, a second term would slow the healing and transformation our economy needs, and which I believe Governor Romney understands or will soon grasp.

Let’s hope.