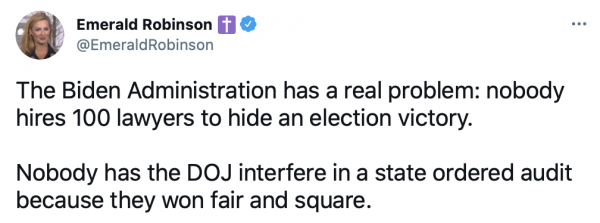

HARSH, BUT FAIR:

Shouldn’t it be “we welcome scrutiny because it will underscore that our victory was fair?” (Bumped).

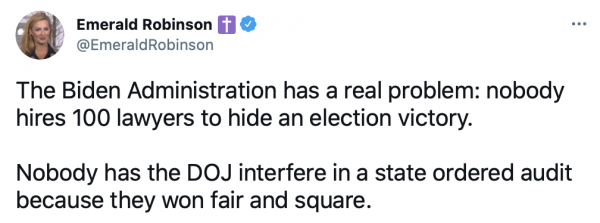

HARSH, BUT FAIR:

Shouldn’t it be “we welcome scrutiny because it will underscore that our victory was fair?” (Bumped).

NOT BAD ENOUGH: This was one of the worst weeks for China on the world stage in a while.

The thing is, China can look as bad on the stage as it wants, when it’s paying off all the critics.

OPEN THREAD: How was your weekend?

WHAT ARE THE DEEP SEVENS UP TO NOW? Earth’s core is growing ‘lopsided’ and scientists don’t know why.

DO TELL: There Could Be a Dark Side to Mandating Vaccination, Survey Finds.

Despite infection rates being 15 times higher in Germany during the second wave in October and November, the data showed that resistance to mandatory vaccinations had increased from the first wave in April and May.

Participants were asked how likely they were to get vaccinated, based on whether the vaccinations were enforced by law or voluntary: During both waves, people were more likely to want to get vaccinated if they didn’t have to, but the gap was bigger the second time around.

When the Germans are pushing back against authority . . .

BUT THE AIR IS CLEANER NOW, AND PEOPLE ARE FATTER: Air pollution exposure during pregnancy may boost babies’ obesity risk.

I WONDER IF I’LL EVER GO INTO SPACE? Blue Origin auctions seat on 1st crewed flight for $28 million.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS:

—Leonardo Castañeda, The San Jose Mercury, September 22, 2020.

● Chaser: California’s stricter COVID rules did not hurt the economy: report.

—Leonardo Castañeda, The San Jose Mercury, today.

● Hangover: Nearly a third of California’s restaurants permanently closed as pandemic set in.

—The AP, May 19th.

WHAT WOULD WE DO WITHOUT EXPERTS? Experts: Too early to tell if yearly COVID-19 booster vaccines needed.

WHAT EVERYONE NEEDS: An SUV that has over 700 hp and can get to 60 mph in just 3.5 seconds.

ANOTHER WIN FOR THE BAD GUYS: Netanyahu Loses Office, Making Way for Naftali Bennett. I don’t expect this to end well.

TOOBIN ON A SUNDAY AFTERNOON: Joe Biden to give Boris a hand in sausage war as he tries to beat off EU.

A TRAINED EYE CAN WORK WONDERS: Some People Can See Through Camouflage, And It’s Not as Hard as You Think.

Night vision is like this too. Some people have better night vision to begin with — including me, though not as much as when I was 20 — but a lot of it is simply learning what things look like in the dark. Your brain is better at decoding the incomplete information it receives when it’s done that before.

“STRETCHING STATE LAW SO FAR HE DESERVES AN OLYMPIC GOLD MEDAL IN GYMNASTICS:” California Governor Gavin Newsom is Trying to Pull Off a Shocking Pandemic Power Grab.

THEY’RE ALWAYS IN THE LAST PLACE YOU LOOK: Two new types of glial cells found in mouse brain.

QUESTION ASKED AND ANSWERED: Why Is Austin Media Refusing to Release Description of At-Large Austin Shooter? Just Kidding. You Know Why.

MELISSA CHEN: “We Let China Have Its Way With the World.”

To be fair, our political and business leaders demanded stiff bribes.

Related: “They won’t say so but the uniparty globalists’ theory of national security is to effect a corporate merger of the US and China. And from there the world. Literally Orwell.”

K-12 IMPLOSION UPDATE: NJ School District Replaces Holidays on School Calendar With ‘Day Off’ After Italian Uprising.

Shouldn’t traditional days of the week be replaced as well, to avoid offending those trigged by the names of celestial bodies and Germanic gods?

LOCKDOWN CASUALTIES: ER visits after suicide attempts up among teens, young adults during pandemic.

LARRY KUDLOW: Is Jimmy Carter Back, or What?

What a minute, though conservatives might hate me for this. President Carter really, truthfully, factually did not launch double-digit inflation of the 1970s. He was merely captured by it, and his presidency was destroyed. I don’t think he really ever understood it. It wasn’t just about oil prices. He did, though, appoint Paul Volcker to run the Fed.

Volcker was my former boss at the New York Federal Reserve Bank. I was his executive assistant 46 years ago. It was Paul Volcker, under President Reagan, who slew inflation. Reagan gave Volcker the ground to stand on. The truth, though, factually and analytically is that the president who unleashed double-digit inflation was Richard Nixon.

That’s right. It was unfortunately the 37th president who closed the gold window where the dollar was exchangeable for gold at a 35th of an ounce. That went back to the post-war deal reached at Bretton Woods, New Hampshire. It restored to the world economy the gold exchange standard with the dollar at the center of that system.

As Amity Shlaes wrote in her 2019 book, Great Society, “Nixon and [John] Connally would now present a policy package containing most of or all their ideas, a package so sudden and revolutionary, like Nixon’s decision to go to China, that it outclassed either the New Frontier or the Great Society for sheer drama. [George] Shultz and Connally got in the spirit. ‘I think it’s the biggest thing in economic policy since World War II,’ Shultz concluded, accurately enough. Nixon had always known he could out-Kennedy Kennedy and out-Johnson Johnson, and now he was going to do it.”

More from Kudlow:

Nixon was worried about trade deficits and a deteriorating balance of payments. He rejected the advice of Volcker, then treasury undersecretary, and the Fed chairman at the time, Arthur Burns. Instead, Nixon closed the gold window, meaning foreign governments could no longer exchange dollars for gold. The value of the greenback fell like a stone.

So as the value of our currency declined, prices denominated in dollars sky-rocketed. We printed bad money and too much of it, and that’s the definition of inflation. Excess money in relation to demand will do it every time. Lack of value will do it every time. In 1973, Nixon abolished all remaining remnants of the gold dollar exchange system.

Inflation soared, first hitting double-digits while Nixon was president. All commodity prices, including oil, sky-rocketed along with just about everything else. On top of that, income tax rates were not indexed to inflation in those days. So higher and higher inflation drove middle-class Americans into higher and higher tax rate brackets. That had a huge braking effect on the economy.

In other words — stagflation. Intermittently from then until Reagan, inflation would pop up to double-digits. Interest rates peaked at about 15% in the market in government bonds. The prime rate peaked at around 21.5%. Reagan came in and squelched it all. As a hard money gold advocate and friend of Milton Friedman, Reagan, who was also my former boss, gave Volcker carte blanche to restore dollar value and vanquish inflation.

Then Reagan slashed tax rates to 28% from 70%, providing fresh after-tax incentives to rejuvenate the economy and give folks back their real income lost during the Nixon-Carter years. Really since the early 1990s, inflation in America has averaged about 2%. That’s for almost 30 years.

One last point on inflation. It is everywhere and always a monetary phenomenon, as Milton Friedman taught us, and, as Presidential Medal of Freedom recipient Art Laffer and Nobel laureate Robert Mundell taught us, the optimal policy mix was stable money and low tax rates.

But Biden is determined to prove Friedman incorrect, telling interviewers that “Milton Friedman isn’t running the show anymore.” And we’re all paying for Biden’s rejection of sound economic policies. “The irony is that Biden’s rejection of Friedman’s teachings on money, taxes, and spending may bring about the same circumstances that established Friedman’s preeminence. In a year or two, the American economy and Biden’s political fortunes may look considerably different than when Janet Yellen blurted out the obvious about inflation. Voters won’t like the combination of rising prices and declining assets. Biden’s experts might rediscover that it is difficult to control or stop inflation once it begins. And Milton Friedman will have his revenge.”

And thus, Welcome Back, Carter.

THE EGO HAS LANDED: Why Obama Failed — Barack Obama Misunderstands His Fundamental Errors.

Obama’s new audience is progressive posterity. He’s attempting to burnish his credentials with the radical activists of the present and the radical historians of the future. He wants to make it clear to them that any ostensible respect he may have shown for Republicans during his career was nothing more than a concession to electoral necessity. He wants them to know that the moderation was all for show — a tragic obligation kenotically undertaken by a progressive savior in a reactionary nation that couldn’t keep up with the pace of his moral leadership.

Ultimately, Obama failed as a leader because, unlike presidents past, he didn’t trust the public. He lacked both the courage and the convictions required to thrive in the democratic polity the birth of which Van Buren chronicled during the 1830s. To borrow from his own terminology, Obama would not prophesy for the public and he could not build coalitions with his colleagues. He knew that history had not dealt him an electorate the makeup of which intersected perfectly with his own ambitions, as it had for Jackson, Roosevelt, and Reagan. This is why he resents his Republican opponents so much. Neither they nor their voters were sufficiently made according to his own political image, an image that he still believes to be the best and clearest evidence of the small measure of moral credibility that can justly be claimed by the United States of America.

Like Carter, Obama will be using the DNC-MSM to try to spin the memories of his time in office for decades to come: Flashback: Poll: Obama ‘worst president’ since World War II.

THE WRITER OF THIS ARTICLE ALSO WROTE THIS HEADLINE AND THAT’S RARE:

Headlines are important. They have the ability to draw readers into a piece that they otherwise might skip. They also have the ability to completely tank an article that is otherwise full of good information. How can you avoid reading a story with the headline “Underwear bandit caught, admits brief crime spree” or the infamous 1983 headline from the New York Post, “Headless body in topless bar”?

Headlines are the first thing news consumers see when searching for stories or columns to read. They are essential in trying to attract eyes on articles writers have spent hours—sometimes even days or months—working on.

And so it is surprising to learn that authors generally don’t write their own headlines. Different publications have different staffing and processes, but for the most part it’s a section or copy editor who writes headlines.

Think about the work that goes into putting out a newspaper, the print kind that leaves your fingers stained with ink. Headlines are dependent on an article’s length, the page’s design, and how many other pieces are on that page. They have to fit within a certain number of columns, and font size might be dictated by a page designer or the publication’s style guide.

“If you think about newspapers, there were column inches. There were fixed widths, and you had to have a headline that fit. So people developed the skill at writing headlines to fit with their particular paper’s style and layout,” Rutgers University history and journalism professor David Greenberg told The Dispatch. “You had to know what you were doing. There was a kind of technical precision to it.”

Related: James Lileks on another aspect of newspaper and Website design: Editorial illustrations have “converged into a uniform blobby minimalist style,” or as Lileks dubs it, “Colorforms Totalitarianism.”

InstaPundit is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.