IT’S THE SPENDING, STUPID: Here Is Goldman’s Chart Showing Why The US Is Headed For “Banana Republic” Status.

Earlier today we discussed a report by Goldman Sachs which, when summarized, suggested that unless something significant changes in the coming years, the current US fiscal policy will lead to a debt catastrophe. In an unprecedented warning, the bank which spawned Trump’s chief economic advisor Gary Cohn, ironically the architect behind Trump’s fiscal strategy, warned that “the continued growth of public debt raises eventual sustainability questions if left unchecked.”

It is worth highlighting that for Goldman to warn that the US fiscal and debt trajectory is unsustainable is quite unprecedented, especially since it is the bank’s former President and COO who has put the US on that path.

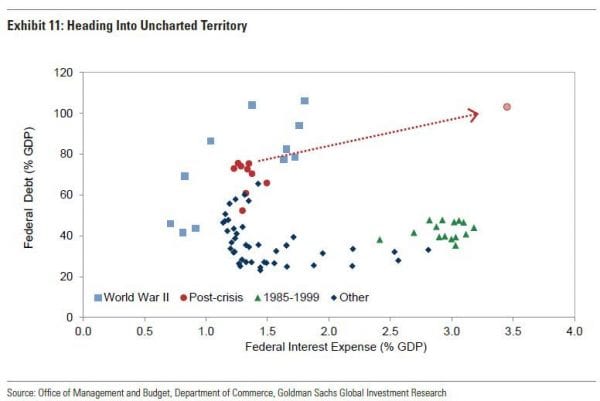

And while we urge readers to get acquainted with Goldman’s list of concerns, all of which are very troubling, there is one specific chart which lays out clearly why the US is now headed for “banana republic” status amid developed economies when it comes to US debt sustainability, or in this case lack thereof.

That chart is below, and it shows total projected US Federal Debt on one axis, and US interest expense as a % of GDP on the other. The result is the red dot in the top right.

This year, doing nothing more than paying the interest on the already-accumulated debt will consume nearly every dollar of revenue generated by corporate taxes, excise taxes, and tariffs. And we’re not many years away from the vig growing larger than the defense budget.

And this spending spree is absent an economic downturn or a shooting war with a near-peer adversary.