Archive for 2021

January 23, 2021

NO, NO ONE CAN: “After permanently banning then-President Donald Trump from its platform, Twitter took only seconds to delete a defiant tweet from his official government account. Yet it’s not nearly so fleet-footed about child pornography and death threats. So can anyone buy its claims to police without bias?”

IN THE MAIL: From Andy Ngo, Unmasked: Inside Antifa’s Radical Plan to Destroy Democracy.

COLLUSION: Biden Proposing to Extend U.S.-Russia Nuclear Arms Deal by Five Years.

Flashback, Walter Russell Mead in 2017:

If Trump were the Manchurian candidate that people keep wanting to believe that he is, here are some of the things he’d be doing:

Limiting fracking as much as he possibly could

Blocking oil and gas pipelines

Opening negotiations for major nuclear arms reductions

Cutting U.S. military spending

Trying to tamp down tensions with Russia’s ally Iran.

Biden’s already ordered a stop to the Keystone Pipeline and a federal fracking ban, while trying to revive the Iran nuclear deal. Just saying.

Related: Biden Rescinds Trump Order Banning Chinese Communist Involvement In US Power Grid.

TRAIN WRECK: The Penn Central’s failure resonates today.

After the merger, the railroads discovered that they had incompatible computer systems, which threw railyards into chaos and angered customers. The Penn Central’s three top officials, too, were incompatible. They “scarcely spoke to one another,” write Daughen and Binzen. Stuart Saunders, the board chairman, was a political guy. Alfred Perlman, the president, was a trains guy. These different outlooks could have complemented each other, but personalities got in the way. Rounding out this dysfunctional triumvirate was Penn vet David Bevan, the top financial official, perpetually “angry and humiliated” at not being picked for the top job.

Bevan had two ideas for keeping the cash-bleeding Penn Central alive: corporate diversification and financial trickery. If a railroad couldn’t make money, he thought, perhaps it could invest its cash in entities that could make money. The Penn had a head start in this; it already owned vast swathes of real estate around Grand Central Terminal and Penn Station, including five hotels and a share in Madison Square Garden, as well as the New York Rangers and Knicks.

Bevan added to this conservative legacy portfolio a bizarre array of new business interests, from an executive-jet company (he was its best customer) to pipelines, speculative land tracts in the southern U.S., and a travel agency. “Nobody . . . could name the 186 different companies . . . under the Penn Central’s umbrella,” Daughen and Binzen write. Under Bevan’s stewardship, these companies often sold stakes of themselves to one another, generating illusory paper profits. The Penn also had touchingly optimistic views about the future, booking years’ worth of profits, for example, when a third party agreed to buy a tract of real estate for which it wouldn’t actually be able to pay for years. Bevan was also determined to take some of the supposed profits of these deals for himself, setting up an “investment club” with several associates to buy and sell shares in these side companies before the much bigger Penn Central did, thus benefiting from the subsequent price changes.

These innovative methods didn’t generate the money that the Penn Central needed to balance the books, however. So Bevan turned to straightforward borrowing. With $1.5 billion in annual revenue, the Penn borrowed hundreds of millions of dollars from the nation’s largest banks, including more than $100 million in the nascent “commercial paper” market. This market of short-term loans was meant not for permanent operating deficits but to cover temporary shortfalls like meeting payroll just before a customer paid for a big order. The banks didn’t ask questions, though, because Penn Central had such a solid reputation—and because it was such a good fee-payer.

This three-card monte game lasted—until it didn’t. At First National City, the predecessor of Citigroup, chief Walter Wriston was “furious at his loan officers for getting his bank so deeply involved”—$300 million in loans—“without knowing what a hole the Penn Central was in.” Members of the Penn Central’s august board were also mad—though many of them perhaps never thought to ask questions because they headed companies that were themselves customers of or vendors for the railroad.

The banks’ and the board members’ big idea was to ask the federal government for a bailout. President Richard Nixon vacillated but ultimately said no, on the basis of the now-quaint idea that Congress would have to agree, which it did not.

The railroad then declared bankruptcy in June 1970, having lasted just 871 days. “Never before had there been a cataclysm as stunning as this,” write Daughen and Binzen. “What had been conceived of as the most awesome transportation machine in the world had ended as the most monumental business failure in United States history . . . How the mighty fell: Stuart Saunders, businessman of the year in 1968, business bankrupt of the year in 1970.” Saunders had a rejoinder: “I didn’t have anything to do with the concept of the Penn Central.”

Read the whole thing. Railfans and those with an interest in spectacular business failures will also enjoy this 20 minute industrial film Penn Central released in 1968 to celebrate their new merger. It’s the equivalent of an infomercial promoting a luxury cruise on the Titanic, or a no-money-down real estate scheme in beautiful downtown Pompeii:

FIGHT THE POWER, STICK IT TO THE MAN: Music professor sues university for punishing him over defense of ‘racist’ composer.

YOU’RE GONNA NEED A BIGGER BLOG: Three Harmful Consequences of Biden Killing the Keystone XL Pipeline.

WHY IS HIGHER EDUCATION SUCH A CESSPIT OF RACIST HATE? ‘Something is wrong with White folk’: Washington & Lee prof has a history of controversial comments.

IT’S SCHEDULED FOR 9:40 ET: Watch live: SpaceX plans morning launch of 143 satellites.

UPDATE: Scrubbbed at the last minute due to weather. Bummer.

I TOO AM CONFLICTED: Amazon and Me.

But ebooks really are a small part of Amazon’s profit, and there is something delightfully subversive in having them market our books.

As a commenter on that post says:

- Codex Says:

January 18th, 2021 at 9:03 pm Please recall that the book business is not where you will pinch the corporate executives at Amazon.On the other hand, having the ‘zon hosting your ++UnGood BadThink stories and facilitating payments to authors of same is glorious.

Do so until they force us off.

CULTURE OF CORRUPTION: Biden Energy Pick Set to Make Millions from Prominent Energy Company: Jennifer Granholm’s ties to energy industry will likely lead to conflicts of interest. To be honest, though, I prefer the crooks to the woke true believers.

HIGHER EDUCATION BUBBLE UPDATE: Kansas universities could speed up faculty dismissals under new Regents proposal.

A subcommittee of the Kansas Board of Regents voted Wednesday to endorse a one-year policy making it easier for state universities to suspend, dismiss or terminate employees, including tenured faculty members, without initiating the process of formally declaring a financial emergency.

The extraordinary proposal unanimously forwarded to the full Board of Regents was based on financial damage to the University of Kansas, Kansas State, Wichita State and three other state universities by the COVID-19 pandemic.

Another issue was Gov. Laura Kelly’s decision in June to cut higher education appropriations by $35 million and her recommendation last week to the Kansas Legislature for a $27 million reduction in state aid to the universities. The Board of Regents asked the governor to restore the $35 million and hold the line in the new state budget. . . .

Under existing Board of Regents’ policy, a state university must formally recognize a financial exigency that required elimination of nontenured positions and operating expenditures. With the declaration, the universities could move ahead with reductions in tenured faculty positions.

The budget proposal outlined by the governor, which serves as starting point of discussion during legislative session, would slash state aid to the six universities by $27 million in the fiscal year starting July 1. Kelly set aside funding for raises to state agency employees, but suggested a $10 million block grant to the Board of Regents to use at its discretion.

The pandemic has just accelerated trends that were already underway.

TO BE FAIR, THE RHETORIC WAS ALWAYS BULLSHIT: After Inaugural Rhetoric on Unity, Biden Signs Divisive Transgender Executive Order.

FROM CELIA HAYES: My Dear Cousin: A Novel In Letters.

When Peggy Becker married Englishman Tommy Morehouse in San Antonio in the spring of 1938, her cousin and best friend Venetia “Vennie” Stoneman was her bridesmaid. After the wedding, Peg and Tommy traveled across the Pacific to Malaya, where Tommy managed his family’s rubber plantation. There they expected to raise a family and live a comfortable and rewarding life among the British expatriates in the tropics, while Vennie returned to Galveston to continue training as a nurse.

The start of the Second World War changed those comfortable, settled lives: Tommy Morehouse became a prisoner of war, Peg barely escaped the fall of Singapore with her small son, and Vennie Stoneman was a nurse in the US Army Nurse Corps, tending to battlefield casualties in North Africa, Italy, and France. In Australia, Peg waits out the war, wondering if her husband will survive brutal captivity by the Japanese, and Vennie risks her own life as an air evacuation nurse. Throughout all, the two women write to each other, of their lives, loves, of Vennie’s patients and comrades, and Peg’s children and the woes of running a wartime household among rationing and shortages of shoes for her children.

HOWIE CARR: Without Trump to Blame, Virus Turns the Corner.

Have you noticed something missing from the home page of your local news outlet in the last couple of days?

COVID-19 has gone MIA.

If not quite totally vanished, the coronavirus is certainly fading from the front pages. No more apocalyptic headlines about “cases” and “infections” which usually mean … not very much.

A year ago, it was the greatest threat to humankind since the Black Death. Now it’s on the verge of becoming just another seasonal virus.

Hmm.

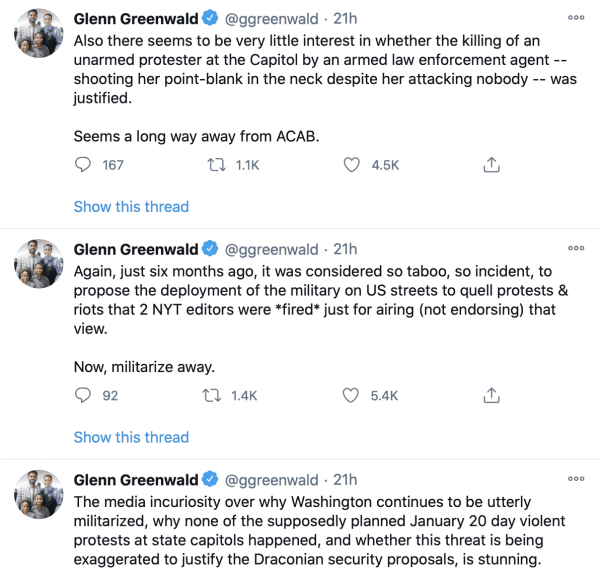

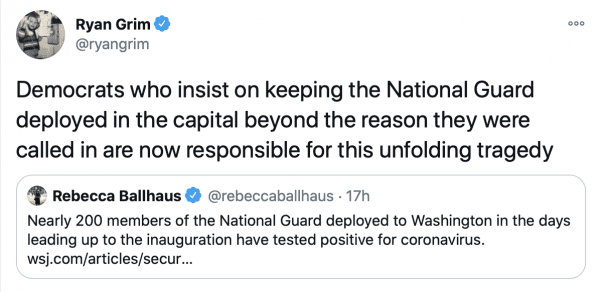

AND THEIR INSANITY: Biden’s militarized inauguration showcased Democrats’ insecurity.

THEY WILL CONTINUE LYING AND STOMPING ABOUT: Speaker Pelosi Will Send Trump Impeachment Article to Senate on Monday, Senate Trial Likely Next Week.

WAS I THE ONLY ONE LISTENING TO HIM DURING HIS CAMPAIGN? Regime Change Back as Policy? JoeBama Sends More U.S. Troops into Syria.

He promised four new wars during his campaign.

IN CHINA SCIENCE MUST FOLLOW THE STATE: Chinese government gives wrist slap to powerful scientist on fraud and plagiarism charges.

It’s the same under the left here.

BECAUSE FORGET THE CONSTITUTION: In Blow to NRA, Judge Rules N.Y. Lawsuit Can Proceed.

THEY BELIEVE THEMSELVES INVENCIBLE: Schumer Calls McConnell’s Filibuster Request ‘Unacceptable’.