THE ATLANTIC CHANNELS CHRISTOPHER HITCHENS: ‘Freedom of Speech Includes the Freedom to Hate.’

To be fair, it’s only “hate” when it comes from the right. From the left, it’s just “passion.”

THE ATLANTIC CHANNELS CHRISTOPHER HITCHENS: ‘Freedom of Speech Includes the Freedom to Hate.’

To be fair, it’s only “hate” when it comes from the right. From the left, it’s just “passion.”

AT AMAZON, fresh deals on bestselling products, updated every hour.

Also, coupons galore in Grocery & Gourmet Food.

Plus, Kindle Daily Deals.

And, Today’s Featured Digital Deal. The deals are brand new every day, so browse and save!

TO BE FAIR, SHE GENUINELY IS A TOOL OF WALL STREET: Hillary’s Wall Street Trust Gap.

Hillary Clinton has an opinion piece in the New York Times on her plans to rein in Wall Street and protect the public from excessive risk-taking. And the most interesting line in it has nothing to do with tax loopholes or Wall Street or inequality or financial regulation at all. “My comprehensive plan has already won praise from progressives like Sherrod Brown and Barney Frank,” she writes, before delving into “what it would do.”

Why all the progressive shout-outs? I do not think it is because Clinton seems to be moving to the left on financial regulation. The plan that she put out in October was already pretty lefty: It imposes a “risk fee” on the largest financial institutions, creates a new high-frequency trading tax, beefs up the Volcker Rule, and on and on. All of that is on top of the existing Dodd-Frank legislation, by the way, which she promises to defend and strengthen.

Rather, it seems to be an attempt to convince the left that she is really on their side. This is a candidate who has racked up millions of dollars in speaking fees from financial firms, along with millions more in campaign contributions. That is to say nothing of the money raked in by her husband. (Or the culpability-by-osmosis many progressives assign to her for the regulatory policy decisions made by Bill’s administration.) All those dollars have left her open to skepticism from progressives and to repeated broadsides from Bernie Sanders, among others. “The truth is, you can’t change a corrupt system by taking its money,” Sanders says in one advertisement, even if he refrains from saying Clinton’s name.

Clinton has thus far not always responded elegantly or convincingly to the charge that she’s on Wall Street’s side.

That’s’ because, as I said, she really is a tool of Wall Street. And she’s not as good a liar as Bill.

DINING OUT WITH THE TERRORISTS: “How do you defeat an enemy in love with death?,” asks David Solway.

WHY WOULD THE GOP LET HIM DO THAT? The Hill: Reid seeks parting gift for unions in sweeping tax deal.

Senate Democratic Leader Harry Reid (Nev.), under pressure from labor allies, is pressing hard for a two-year moratorium of ObamaCare’s “Cadillac tax” in a major tax deal that negotiators hope to wrap up by Monday.

Reid has assured labor leaders that freezing the Cadillac tax on high-benefit insurance plans is a top personal priority, and he wants to get it done now, knowing he has only a year left as Senate Democratic leader.

Some Republicans, such as Sen. Dean Heller, also of Nevada, support getting rid of the Cadillac tax, but Reid is doing the heavy lifting to make sure it’s part of a year-end deal, according to sources familiar with the talks.

“Leader Reid feels very strongly, in my opinion from discussions with him, that this needs to be done and it needs to be done now. And I think he is confident that will occur,” said Harold Schaitberger, general president of the International Association of Firefighters, who met with Reid this past week.

Suspending the Cadillac tax in a package that would extend an array of expired tax provisions would be a major win for labor unions, who have at times voiced their displeasure with Democrats this year.

They all lined up to pass ObamaCare. Let ’em live with the consequences, unless they’re willing to line up to repeal the whole thing.

CALIFORNIA CLIMATE POLICIES CHILLING HOUSING GROWTH: State Supreme Court ruling will make California housing even pricier.

Exhibit A in the Drawbridge Effect. As James Delingpole wrote last year, “You’ve made your money. Now the very last thing you want is for all those trashy middle class people below you to have a fair shot at getting as rich as you are.”

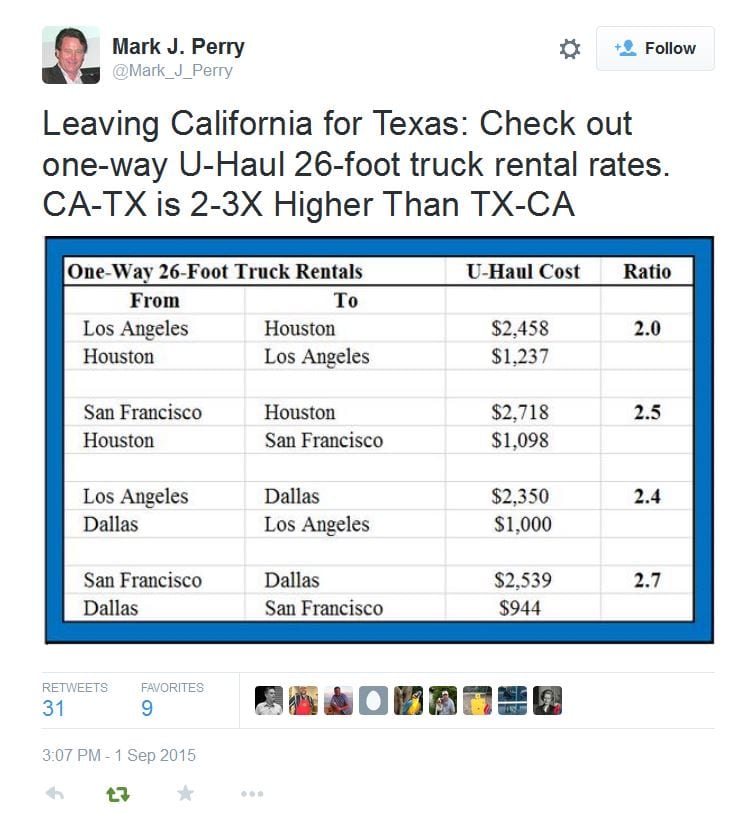

By the way, you know what else is also pricier?

WELL, THAT’S BECAUSE THEY’RE RUN BY IDIOTS: Schools continue to grapple with ‘Huckleberry Finn.’

After The Adventures of Huckleberry Finn was published in 1885, the book was boycotted in some places in the United States for portraying friendship between a black man and a white boy.

“In its time, it was derided and censored,” said Deborah Caldwell-Stone, deputy director of the American Library Association’s Office for Intellectual Freedom, which tracks challenges to books.

Today, Mark Twain’s classic – about a boy who flees his abusive father and travels down the Mississippi River with an escaped slave – is still sometimes challenged in American schools, but for nearly the opposite reason: its liberal use of the N-word and perceived racist portrayals of black characters.

This week, a Montgomery County school removed Huckleberry Finn from its curriculum after a group of students said the book made them uncomfortable.

After a forum for students and faculty, the administration of Friends’ Central School decided to strike the book from the 11th-grade American literature class, principal Art Hall said in a letter to parents this week.

“We have all come to the conclusion that the community costs of reading this book in 11th grade outweigh the literary benefits,” Hall said in his letter.

We used to make fun of the Bowdlers for “bowdlerizing” works of great literature to suit schoolmarmish sensitivities.

HIGHER EDUCATION BUBBLE UPDATE: Is college worth it? Goldman Sachs says not so much.

College is certainly an investment, but it’s worth it — right?

Maybe not, according to new research from Goldman Sachs.

The company said in a research note published in early December that the average return on college is falling. In 2010, students could expect to break even within eight years of finishing school. Since then, that has increased to nine years. And if this trend continues, students who start college in 2030 without scholarships or grants, it said, may not see a return on investment until age 37.

Recent graduates can relate to the report. Mary Kate Baumann, a 2010 graduate of a private college in upstate New York who also graduated from journalism and business graduate programs at the University of Missouri this year, said, “My undergraduate education was over $200,000 in total and my first job paid only $28,000. That’s a large disparity.”

And the value of a degree from Mizzou is probably falling even faster than the average. . . .

SEND THEM TO BED WITH NO COOKIES: America, We Have a Problem.

IF YOU WERE A TIME-TRAVELER, AHAB: Researchers re-analyze 15-million-year-old sperm whale fossil, find ‘white whale’.

I EXPECTED EYE OF NEWT IN THERE SOMEWHERE: New Hybrid Fuel Cell Made From E. Coli, Gold, And Titanium.

BUT IT GIVES THE IMPRESSION THEY’RE DOING SOMETHING: Stump the WH: So Josh Earnest, how many mass shooters have been on the ‘no-fly’ list you’re so obsessed with?

IF YOU INTERRUPT BIG BROTHER, YOU MIGHT STOP TO THINK: The Narrative Can Never Be Wrong.

IS IT: Islam: religion or not?

HOW NOT TO WIN FRIENDS AND INFLUENCE PEOPLE: Dems Turn to Mocking Terror Fears.

EMOTIONAL BUBBLE-BOYS: Student Protesters Claim That a Fundraiser for Kids With Cancer Was a Microaggression. Seems like an unbelievable frappe of self-absorption and cry-bullyism.

CURIOSER AND CURIOSER: Dems Drop TV Station From New Hampshire Debate Citing Labor Dispute.

MINE THE STARS: The coming cosmic Gold Rush.

IN THE FUTURE WE’RE ALL ROBOTS: Colorado Woman Gets Bionic Eye.

SO PEEING YOURSELF IS A CRY FOR HELP: Wee-fi: urine-powered socks can send message in emergency.

DON’T YOU JUST HATE IT WHEN THAT HAPPENS: Friend says Lord Lucan killed himself after murdering the family nanny by mistake.

WESTERN CIVILIZATION IS ONLY MOSTLY DEAD: Hundreds turn out for funeral of WWII veteran who had no known relatives.

IF FEMINISTS WEREN’T TOO FRAGILE TO ALLOW IT: Boys should have the right to say no to feminism.

InstaPundit is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.