FDA BANS asthma inhaler.

Archive for 2011

July 23, 2011

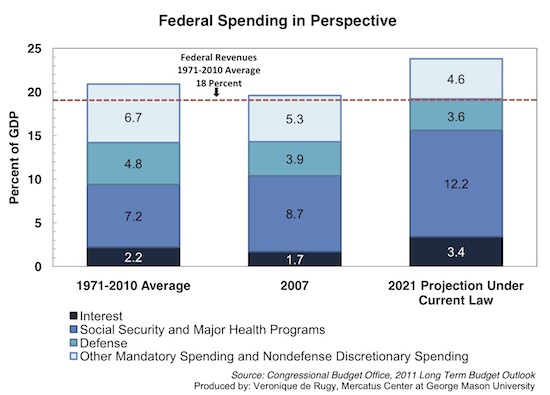

VERONIQUE DE RUGY: Federal Spending In Perspective.

LOOKING INTO socialism’s historical roots.

AT AMAZON, bestsellers in Mystery and Thrillers.

It’s going to take more than Amanda Marcotte to do that. . . . From the comments: “Marcotte is a sexist pig, so why should anybody listen to her? She’s just afraid of an angry black man, so she is lashing out in a racist way.”

Yeah, first Debbie Wasserman-Schultz, now Amanda Marcotte: What is it with the Democrats sending white women to attack a black man, anyway? Are they trying to play on gendered racial fears among white voters? It’s some kind of dog-whistle, isn’t it?

HOW THE KHAN ACADEMY is changing the rules of education.

The videos are decidedly lo-fi, even crude: Generally seven to 14 minutes long, they consist of a voice-over by Khan describing a mathematical concept or explaining how to solve a problem while his hand-scribbled formulas and diagrams appear onscreen. Like the Wizard of Oz, Khan never steps from behind the curtain to appear in a video himself; it’s just Khan’s voice and some scrawly equations. In addition to these videos, the website offers software that generates practice problems and rewards good performance with videogame-like badges—for answering a “streak” of questions correctly, say, or mastering a series of algebra levels. (Carpenter has acquired 52 Earth badges in math, which require hours of toil to attain and at which his classmates gaze with envy and awe.)

Initially, Thordarson thought Khan Academy would merely be a helpful supplement to her normal instruction. But it quickly become far more than that. She’s now on her way to “flipping” the way her class works. This involves replacing some of her lectures with Khan’s videos, which students can watch at home. Then, in class, they focus on working problem sets. The idea is to invert the normal rhythms of school, so that lectures are viewed on the kids’ own time and homework is done at school. It sounds weird, Thordarson admits, but this flipping makes sense when you think about it. It’s when they’re doing homework that students are really grappling with a subject and are most likely to need someone to talk to. And now Thordarson can tell just when this grappling occurs: Khan Academy provides teachers with a dashboard application that lets her see the instant a student gets stuck.

Read the whole thing.

REPORT: Homeowners In Denial About Value Of Properties. That seems right to me. The stuff in my neighborhood that sells goes for around 15% less than it got in 2005/2006, but I still see people putting their houses on the market for $100K more than the 2005 price. Unsurprisingly, those don’t sell. In some cases, the sellers wind up paying a mortgage on an empty house for a year or more before finally cutting the price. By then, of course, the market has fallen farther, and the realistic selling price is lower than it would have been initially, meaning a double-loss: Payments on an empty house, and a further reduced selling price.

Note this: “Humphries foresees home values continuing to fall through the middle of next year for a variety of reasons, including persistent unemployment, a significant pipeline of homes in foreclosure, as well as high rates of homes with negative equity, which means many more will likely end up in foreclosure. A return to a ‘normal’ market is likely at least three away, he says.”

My advice: If you have to sell now, price to sell quickly. It will only get worse.

RAND SIMBERG: Another Catastrophic Failure Of Gun Control:

It took almost a day for some on the left to blaming Sarah Palin for what happened in Norway. It probably took a while for them to get over their cynical shock that it actually was a white guy this time.

I will note, though, as an aside, that that like school shootings in “gun-free zones,” this was another catastrophic failure of gun control.

Indeed.

WINE-RELATED iPhone Apps.

JONAH GOLDBERG: Democrats’ Tax Problem. “In fairness, Republicans successfully sell their anti-tax message not because they have better orators or buy craftier linguists, but because taxpayers don’t feel they’re getting a lot of value for their dollars, and most suspect they could feel the same ‘awe and respect’ for half the price.”

INTERESTED IN DISASTER-PREPAREDNESS? You might want to drop by Bill Quick’s discussion forum. And here’s a list of “must-read” survival books.

AT AMAZON, markdowns on laptops. Also on netbooks.

KEVIN WILLIAMSON ON THE DEBT: The Democrat Downgrade: Reality and Repercussions.

Question: How many U.S. banks and insurance companies do you think will remain rated AAA if the U.S. government gets downgraded?

That is not a rhetorical question.

The direct consequences of a downgrade of Uncle Sam’s credit on U.S. public finances would be pretty bad. But, as with natural disasters, the aftershocks of this man-made catastrophe might prove more devastating than the main event. In this case, imagine a tsunami of rolling corporate downgrades following the earthquake of a Treasury downgrade, a run on the banks, a discredited FDIC, frozen money-market funds, and a plunging dollar.

It’s not Beijing that’s going to take it in the shorts — it’s our still-fragile financial system.

Standard & Poor currently gives AAA ratings to six major insurance companies: New York Life, Northwestern Mutual, etc. Those companies already are on the watch-list for a downgrade, simply because of their extensive holdings of U.S. Treasury securities — regardless of the fact that Treasuries themselves have not yet been downgraded. . . . The thing that has not been sufficiently understood, I think, is this: The United States is not on a downgrade watch because the markets fear we won’t raise the debt ceiling in time to avoid a default; the United States is on a downgrade watch because the markets believe the debt-ceiling debate presents the last real opportunity for the government to enact a meaningful fiscal-reform program before it is well and truly too late to avoid a national crisis. The credit agencies, wisely or not, aren’t worried about the short-term political fight leading to an immediate default, but about the near- to medium-term fiscal situation, which is plainly unsustainable.

Read the whole thing. And note that some ratings agencies have already downgraded the U.S.:

Credit rating agency Egan-Jones has cut the United States’ top credit ranking, citing concerns over the country’s high debt load and the difficulty the government faces in significantly reducing spending.

The agency said the action, which cut U.S. sovereign debt to the second-highest rating, was not based on fears over the country not raising its debt ceiling.

Instead, the cut is due the U.S. debt load standing at more than 100 percent of its gross domestic product. This compares with Canada, for example, which has a debt-to-GDP ratio of 35 percent, Egan-Jones said in a report sent on Saturday.

You have been warned. Meanwhile, reader Michael McFatter writes with a troubling thought:

I’m worried. See if you follow my concern. Thus far the Democrats have proved intractable on these negotiations. But more than that, they seem to be living in denial as regards the national debt and more importantly the deficits. Right now we’re projecting deficits of 1.5 trillion every year for the next ten years. But those projections are based on growth rates of something like 3 – 3.5% from 2013 onwards. Which is unrealistic when you consider the current debt load plus piling on 1.5T more every year. It’s obvious that these projections are pure fantasy. They’re in denial about Social Security, Medicare, and Medicaid sustainability and about Obamacare. They genuinely believed O-care was going to “bend the cost curve”! It’s ridiculous.

Now, we all know this. None of this is new information. What has me worried is the idea that the Democrats ACTUALLY DON’T UNDERSTAND THIS IS THE END OF THE ROAD. What if they actually aren’t capable of recognizing when they’ve lost? Or when we’ve run out of other people’s money? None of these people work for a living. Their concept of where money comes from and how wealth is created (and destroyed) is completely divorced from reality because they live in a government bubble. And the very small minority among them that do understand this from previous jobs and experience are okay with Progressive policies aimed at leveling/equalizing/delivering-economic-justice because they just assume that the economy can handle some siphoning. And usually it can. But not at this volume or for this time scale.

Here’s the position I think we may be in. We’ve been negotiating with the President and The Democrats in Congress on the assumption that they’re sane. It’s okay to play hardball with these guys because eventually, whether they like it or not, reality insists upon itself and they have to cave. It’s a painful process so you expect some tantrum throwing and caterwauling, but eventually they HAVE to accept reality. Except if they’re not sane. If they want five apples and there’s only two plus two but they CAN’T ACCEPT that two plus two equals four. Orwell wasn’t just writing a parable about the eventual end point of IngSoc. He was describing what human psychology can drive Ministers to inflict upon the populace for the sake of “justice”. I’m worried they’ll pull the trigger on default as just one more “political” step in the march towards freedom from want or whatever other principle they’re operating under. They’re playing this game as if they could win, as if taxes in a downturn are a good idea with benign consequences. As if debt equivalent to GDP is survivable for the world’s anchor economy/currency, let alone sustainable.

And so maybe, just maybe, Republican strategy (what little there is of it) has badly misread the opposition. Obama tried to add 400 billion in taxes to a deal he had already agreed with Boehner at the last minute. Boehner walks out cause Obama is negotiating in bad faith and has been all along, but what if Obama is actually incapable of good faith negotiation? I think right now that it’s actually possible we won’t see a deal at all. Because the Republicans are looking at the math and at reality and saying “Okay, Democrat demands can’t be serious because they can’t possibly work” and Democrats are looking at politics and how it works and saying “We don’t have to give in cause that’s not how you win these things. You pin it on the other guy politically and then reap the political dividends.” I wasn’t around for the start of WWI, but I get the feeling I understand Kennedy’s fascination with Tuchman’s Guns of August. I’m not talking about a shooting war, but about leaders overestimating and underestimating and just plain misjudging each other in a brinksmanship scenario. In short, it could be too late to do anything when people finally wake up. The crisis may have already arrived with an economic and fiscal momentum all it’s own that no amount of dealing or compromise or statesmanship can stop..

Actually, Tuchman’s The March Of Folly seems equally applicable. Or maybe you just want to skip Tuchman and go straight to Dave Voda’s How To Protect Your Money From The Coming Government Hyperinflation. . . .

UPDATE: Jim Bennett emails: “What problem? All they have to do is find Scrooge McDuck’s money bin and haul it away in trucks to the Treasury, and that fixes everything. Except that they haven’t been able to find it yet. But it’s there, it really is.”

ANOTHER UPDATE: Reader Warren Bonesteel writes:

“The crisis may have already arrived with an economic and fiscal momentum all it’s own that no amount of dealing or compromise or statesmanship can stop”

Sorry, but its too late. We’re already there. Embrace the doom. The ‘crisis’ has already arrived. …but no one wants to admit it. That’s the real insanity of the situation. Were it a house fire? The fire has already engulfed the building. There’s nothing left to save. We must begin anew, from scratch.People keep looking for a magical solution or for a ‘saviour’ or a hero. We’re it, I’m afraid…and no one else is going to show up and magically save us from our own folly. Even a decade ago, it was too late. Twenty or thirty years ago? Yeah, we could’ve changed our trajectory and altered the outcome. Now, it is simply too late. Stock upon the beans, bullets and band-aids and get to know your local prepper/survivalist.

I hope that’s wrong.

ASSOCIATED PRESS: White House Shifts On Debt:

The roller-coaster debate over raising the nation’s debt limit has forced the White House to explain away, brush aside or even ignore declarations by President Barack Obama and aides that no longer served much purpose in the unpredictable negotiations.

First, the White House wanted a congressional vote separated from spending cuts. Now the administration likes them linked.

Obama said he would reject any short-term deal to raise the borrowing limit. Now the White House says he could make an exception.

He pledged to meet with congressional leaders every day until a deal was reached. But the daily meetings stopped or at least disappeared from his schedule. He did summon lawmakers to the White House for talks Saturday after the top House Republican walked out Friday night.

But they’re “shifts,” not “flipflops,” as the story is careful to note.

MICHAEL LEDEEN: Assassinations And Teaching Moments.

THANK YOU, ILLINOIS TAXPAYERS, for my cushy life. “Protests against efforts to reform pay scales, teaching loads, and retirement benefits employ a ‘solidarity forever, the union makes us strong’ rhetoric. What these professors and other government workers do not understand is that they are not demanding a share of the profits from the fat-cat bourgeoisie. They are squeezing taxpayers—for whom the professors purport to advocate—whose lives are in most cases far harsher than their own.”

LIVE FAST, DIE YOUNG: Amy Winehouse has died.

AN RNA DRUG for high cholesterol.

AN 11-YEAR-OLD WRITES on the end of the Harry Potter era.

JOHN PODHORETZ: The President Is Actually Trying to Talk the Markets Into a Panic. “Perhaps for the first time in American history, this president is literally using this press conference to create a financial panic over the weekend about the opening of the markets on Monday. He is warning of disaster on Monday. Clearly, he wants to use this as leverage to frighten the GOP into passing the plan proposed by Senate Minority Leader Mitch McConnell, which will push the debt ceiling problem into 2013, but it’s still an entirely new and astonishingly reckless gambit.”

Related: Prof. Jacobson: “If nothing else, Obama does ‘panic’ well.” “Obama’s Friday afternoon press statement was not the first time and it will not be the last time. Crisis and panic are, in the words of Rahm Emanuel, just opportunities.”

UPDATE: A Wall Street reader emails: “Unlike most politicians, markets learn and adapt. The main topic among macro investors these weeks is how predictable the panic/response political functions have been in both Europe (Greece default risk) and Washington (debt limit drama). For all the screaming and headlines, US stocks have gone sideways all year. The most cynical investors are placing side bets on where the next US military action will be, as it seems to take ever-greater crises to trigger an exploitable panic.”

IN THE MAIL: From Margaret Hoover, American Individualism: How a New Generation of Conservatives Can Save the Republican Party.